SMEs make up the backbone of the global business world. These enterprises represent 90% of businesses worldwide and generate 7 out of 10 jobs in emerging markets. Getting SME loans remains the biggest problem for many business owners.

The numbers tell a striking story. Developing countries face an annual financing gap of $5.2 trillion for formal micro, small, and medium enterprises. Traditional banks used to be the primary source for SME financing, but the funding landscape has changed drastically. Credit unions have boosted their small business lending by more than 50% between 2017 and 2021. Online lenders now process loan applications within 24 hours.

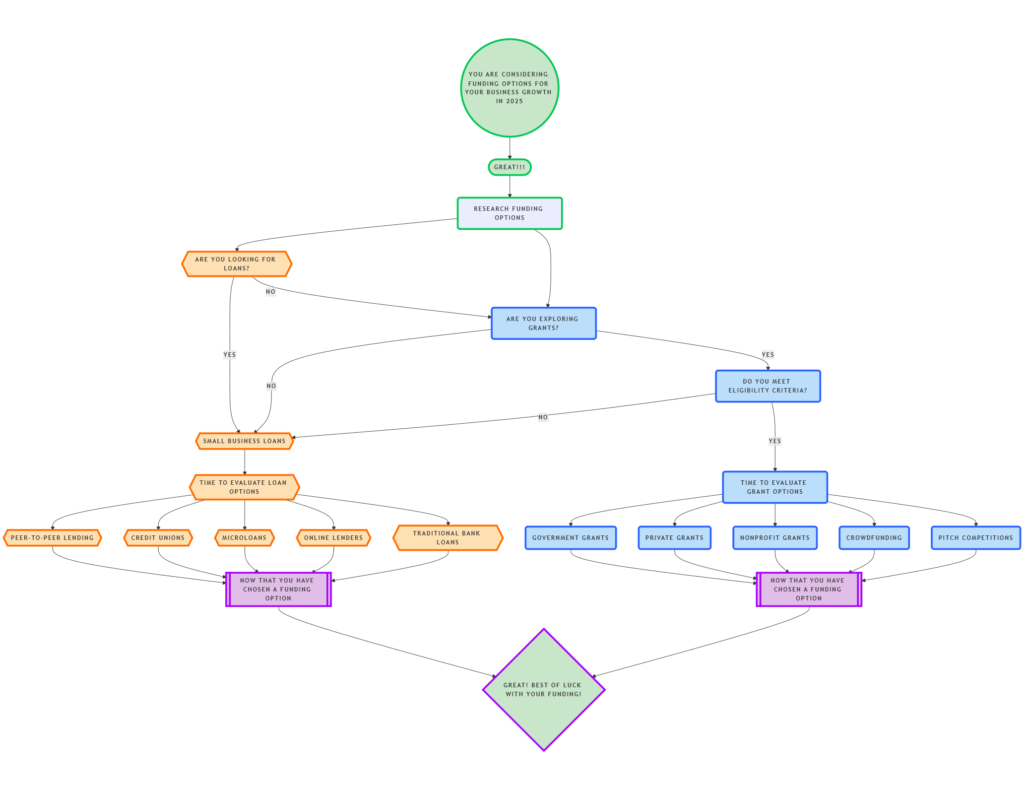

Your business needs capital to grow, and we want to help. This piece offers a detailed guide about the various types of SME loans available in 2025. You’ll find everything about traditional bank loans, government programs, and alternative funding sources to help you make the right choice.

Traditional Bank SME Loans

Image Source: SME loan

Traditional banks are still the go-to source for 2+ year old SMEs looking for stable, long-term funding solutions. Bank loans give qualified businesses well-laid-out repayment schedules and competitive interest rates.

Term Loan Features and Benefits

Traditional banks provide lump-sum financing through term loans with fixed repayment schedules. These loans range from $5,000 to $5 million and businesses can repay them over seven years. You’ll need to show strong financial health with annual revenues between $100,000 and $250,000. A personal credit score above 700 is also required to qualify.

Working Capital Loan Options

Working capital loans help businesses handle their short-term operational needs. These loans help companies manage daily expenses like payroll, inventory, and utilities. Banks offer both secured and unsecured options. Unsecured loans go up to $50,000 while secured loans can reach $250,000.

Equipment Financing Solutions

Equipment financing is a special type of lending where your purchased equipment acts as collateral. Your business can get up to $500,000 for machinery, vehicles, and technology purchases. This financing comes with tax benefits that let businesses write off up to 100% of equipment costs in the same year.

SME Loan Interest Rates and Terms

Several factors affect SME loan interest rates. Current rates for fixed-rate loans average 7.85%, while variable-rate loans sit at 8.79% as of Q1 2024. These key factors influence your rates:

- Your credit profile and business history

- How much you borrow and for how long

- What collateral you can offer

- Your annual revenue and cash flow

You need at least two years of business operations and strong annual revenue to qualify for traditional bank loans. Secured loans often come with better terms and lower rates than unsecured ones because they’re less risky for lenders.

Government-Backed SME Financing Programs

Image Source: Small Business Administration

Government financing programs are a vital support system for small and medium enterprises through loan guarantees and direct funding options. The U.S. Small Business Administration (SBA) spearheads these initiatives to back SME growth.

Small Business Administration (SBA) Loans

SBA’s loan guarantees help lenders finance small businesses confidently. Their flagship 7(a) loan program provides funding up to $5 million. The SBA guarantees 85% for loans up to $150,000 and 75% for higher amounts. The SBA Express program takes just 36 hours to process applications for loans up to $500,000.

State-Specific SME Support Schemes

The State Small Business Credit Initiative (SSBCI) is a game-changing $10 billion investment in American small businesses. We invested in this program to generate up to $10 of private investment for every $1 of SSBCI funding. States give out these funds through:

- Loan participation programs

- Loan guarantee initiatives

- Collateral support mechanisms

- Equity/venture capital investments

- Capital access programs

Government Grant Programs

Federal grants give non-repayable funding for specific business purposes. The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs are great ways to get funding. These programs back scientific research that has high commercialization potential.

The USDA’s Rural Development Business Programs provide extra support to rural community businesses. These grants help companies that have fewer than 50 employees and less than $1 million in gross revenue. The State Trade Expansion Program (STEP) helps businesses break into international markets by covering export-related costs.

The Minority Business Development Agency gives targeted grants to minority-owned businesses throughout the year. These programs welcome breakthroughs and create jobs in local communities while supporting underserved business owners.

Digital Lending Platforms for SMEs

Image Source: Market.us

Digital platforms have transformed SME lending with faster approvals and flexible qualification criteria. Businesses can now get quick access to capital. Most applications are processed within 24-48 hours.

Online Business Loan Providers

Online lenders have optimized their application process and ask for minimal documentation. Businesses can get funding between $25,000 and $500,000, with APRs from 6% to 99%. These platforms help businesses that need quick funding or cannot qualify for traditional bank loans.

P2P Lending Platforms

Peer-to-peer lending creates a direct connection between businesses and investors through online platforms. iBusiness Funding (formerly Funding Circle) offers loans up to $500,000 to businesses with credit scores above 660. Prosper provides funding up to $50,000 with interest rates between 8-36%.

Supply Chain Financing Options

Supply chain finance (SCF) brings a fresh approach to optimize cash flow within supply chains. Suppliers can receive early payments while buyers extend their payment terms. The benefits include:

- Quick access to working capital

- Lower credit risk through buyer creditworthiness

- Better supplier-buyer relationships

- More affordable financing compared to traditional loans

Invoice Financing Solutions

Invoice financing gives businesses immediate access to funds against their outstanding invoices. Lenders advance 80-90% of the invoice value. B2B businesses with long payment cycles find this option particularly useful. The process involves selling invoices at a discount, with fees between 1-4%.

SMEs looking for digital financing solutions will find these platforms better than traditional lending options. The approval process looks at business performance and customer creditworthiness rather than just the company’s credit history. These alternatives have become popular among businesses that need quick capital or have limited credit history.

Collateral-Free SME Loan Options

Image Source: Sunwise Capital

Businesses have several financing options without pledging assets in 2025. These no-collateral solutions help companies access capital quickly, though they cost more than traditional secured loans.

Unsecured Business Loans

Unsecured business loans let companies borrow $10,000 to $100,000 without collateral. The fixed rates begin at 7.50% with terms between 12 and 60 months. Qualifying businesses must have:

- Annual revenue of $100,000 or higher

- Personal credit score above 700

- Minimum two years in business

Revenue-Based Financing

Revenue-based financing gives businesses capital in exchange for a share of future revenue. This solution works best for companies that show strong cash flow and brings value to personal services, business services, and retail sectors. The payment structure adjusts with monthly performance, which helps during slower business periods.

Business Credit Cards

Business credit cards help build credit and manage daily expenses. Many cards come with special intro APR deals – some offering 0% APR through nine billing cycles. Companies can earn cash back rewards between 1.5% and 2% on purchases and track their spending with expense management tools.

Merchant Cash Advances

Merchant cash advances (MCAs) work differently than standard loans by providing quick funds based on future credit card sales. Businesses typically pay back 10% to 20% of daily credit card transactions. Factor rates range from 1.09 to 1.5 or higher, with advances from $2,500 to $1 million. MCAs work well for businesses that need quick capital for:

- Temporary cash flow assistance

- Inventory purchases

- Equipment repairs

- Working capital needs

Alternative SME Funding Sources

Image Source: Webstarted

SMEs now have powerful new ways to get growth capital through innovative funding mechanisms. Global venture capital volumes hit USD 445 billion in 2022 – fifteen times more than in 2006.

Venture Capital Funding

Venture capital investments target high-growth companies and provide capital for equity stakes. The process starts when companies find good investors, share their business plans, and go through due diligence reviews. VC funds usually focus on specific industries or regions. Companies receive investments in rounds as they achieve their milestones.

Angel Investment Options

Unlike venture capital firms that manage investment funds, angel investors put their personal wealth into small business ventures. These investors look for a 30% return on investment. They also bring several benefits beyond money:

- Technical and management expertise

- Professional network connections

- Better market reputation

- Hands-on management help

Crowdfunding Platforms

The crowdfunding market adds USD 1.03 billion to the US economy. Average campaigns raise USD 8,000. There are four main types of crowdfunding:

- Rewards-based: Backers get perks for their support

- Equity-based: Investors receive company shares

- Debt-based: Works like peer-to-peer lending

- Donation-based: Helps social causes

Business Incubator Programs

Business incubators help startups succeed more often. Companies in these programs have an 87% survival rate after five years, while only 44% of other businesses make it. Most programs work with 23-24 companies at once and provide complete support through:

- Shared office services and network setup

- Business advice and coaching

- Entrepreneur network access

- Professional mentoring

Comparison Table

| Funding Option | Funding Amount Range | Interest Rates/Costs | Key Requirements | Processing Time | Notable Features |

|---|---|---|---|---|---|

| Traditional Bank Loans | $5,000 – $5 million | Fixed: 7.85% Variable: 8.79% | – Credit score >700 – Annual revenue $100K-$250K – 2+ years in business | Not mentioned | – Fixed repayment schedules – Both secured and unsecured options – Equipment financing up to $500K |

| Government-Backed SME Financing | Up to $5 million (SBA 7(a)) | Not mentioned | Varies by program | 36 hours (SBA Express) | – 85% guarantee for loans up to $150K – 75% guarantee for higher amounts – Non-repayable grant options available |

| Digital Lending Platforms | $25,000 – $500,000 | 6% – 99% APR | Varies by platform | 24-48 hours | – Simple documentation – P2P lending options – Invoice financing (80-90% advance) |

| Collateral-Free Loans | $10,000 – $100,000 | Starting at 7.50% | – Credit score >700 – Annual revenue >$100K – 2+ years in business | Not mentioned | – No collateral needed – Fixed rates – Terms: 12-60 months |

| Alternative Funding Sources | Varies by source | 30% ROI (Angel Investors) | Varies by source | Not mentioned | – VC funding for high-growth companies – Crowdfunding average: $8,000 – 87% survival rate with incubators |

Conclusion

The small business funding landscape has changed by a lot, giving companies many ways to get growth capital in 2025. Bank loans work well for 5-year old businesses, while government programs give crucial support through guarantees and grants. Digital platforms have made quick funding available to more people, and they process applications within 24 hours.

Business owners should review their needs, financial health and growth plans before picking a funding option. Companies with good credit scores can get better rates from traditional bank loans. Digital lending platforms might work better for those who need money quickly. On top of that, government-backed programs give great terms to businesses that qualify.

Alternative funding sources have opened up new doors beyond regular lending. Angel investors and venture capital firms don’t just provide money – they bring expertise and valuable networks too. Crowdfunding platforms have made capital available to more people, which helps innovative projects and startups the most.

Getting SME funding depends on good preparation and knowing your options. Businesses need strong financial records, solid credit profiles and clear growth strategies to catch the eye of lenders or investors.

FAQs

What are the best loan options for small businesses in 2025?

SBA 7(a) loans are highly recommended for small businesses with good credit and finances. They offer low interest rates, long repayment terms, and substantial funding amounts. Traditional bank loans and digital lending platforms are also viable options, depending on your business’s specific needs and qualifications.

How can government-backed programs help SMEs secure funding?

Government-backed programs, like those offered by the Small Business Administration (SBA), provide loan guarantees and direct funding options. These programs often feature lower interest rates, longer repayment terms, and higher approval rates, making them an excellent choice for many small businesses.

What are the advantages of using digital lending platforms for SME financing?

Digital lending platforms offer faster approval processes, often within 24-48 hours, and more flexible qualification criteria. They provide quick access to capital, with funding amounts typically ranging from $25,000 to $500,000, making them suitable for businesses needing rapid funding or those unable to qualify for traditional bank loans.

Are there any collateral-free loan options available for SMEs?

Yes, there are several collateral-free options available, including unsecured business loans, revenue-based financing, business credit cards, and merchant cash advances. These options offer flexibility and quick access to capital, though they may come with higher interest rates compared to secured loans.

What alternative funding sources can SMEs explore for growth capital?

SMEs can explore venture capital funding, angel investments, crowdfunding platforms, and business incubator programs. These alternatives not only provide capital but often offer additional benefits such as expertise, networking opportunities, and mentorship. The choice depends on your business stage, industry, and growth potential.

Which industries do SMEs most frequently seek bank loans to support their finances?

SMEs across diverse sectors utilize bank loans, but some rely more heavily on them. Manufacturing and construction SMEs often need loans for equipment and project financing. Retailers and hospitality businesses may require loans for inventory, expansion, or managing seasonal fluctuations. Technology startups often seek funding for research and development. Additionally, healthcare, agriculture, transportation, and professional services SMEs may need loans for equipment, operations, or growth initiatives. The specific needs vary based on industry dynamics, size, and economic conditions.